You get a payslip at the end of every month and the most you do is look at the bottom right-hand corner to find out how much is actually going to hit your bank account, right?

Yep, this is true for you and everyone else but it is also a good idea to find out what all the parts of your payslip are and what they mean.

If you know what you are looking at you can make sure that not only are you getting paid the right amount but also that you are being taxed correctly and that your pension payments are being made.

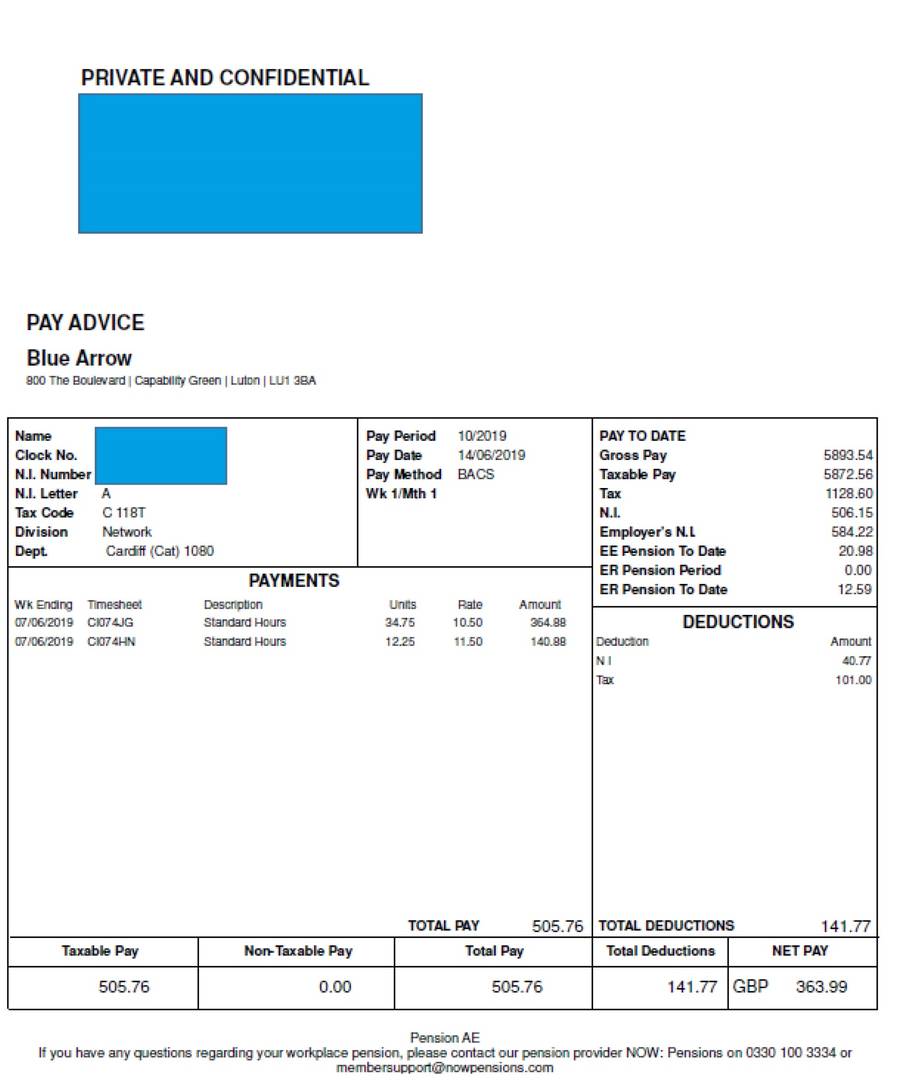

Sample Payslip

Along the top

- Starting at the top left of your payslip you will find your personal details. This is usually where you will see your name, National Insurance number, and tax code displayed.

- Moving to the next section on the right you will find details of the pay period that this slip covers and the date that the payment will be made to your bank account.

- Moving right again is a section that displays your Pay To-Date. These figures are totals of all your earnings from this employment in this tax year (from 6th April one year to 5th April the next year).

Within this section there are quite a few different headers and figures:

- Gross Pay: The total amount paid to you before tax that was deducted in this tax year.

- Taxable Pay: The amount of your earnings that have been taxed in this tax year.

- Tax: The total amount of tax paid by you so far in this tax year.

- NI: The total amount of National Insurance contributions made by you in this tax year.

- Employers NI: The amount of National Insurance your employer has paid on your earnings in this tax year.

- EE Pension to Date: The workplace pension payments you have contributed from your wages in this tax year.

- ER Pension To Date: The payments your employer has contributed to your workplace pension in this tax year.

Deductions

This section shows the money taken from this pay period for Tax and National Insurance.

Payments

This section shows the money you have earned from all of your roles under this employer. They are summaries of your submitted timesheets displayed on a separate line each.

Within this section there are a few different headers and figures:

- Wk Ending: this is the week that you are being paid for.

- Timesheet: this is the reference number from the timesheet you submitted.

- Description: This is the type of hours you worked, i.e.: standard hours, overtime hours.

- Units: These are the total number of hours you are being paid for.

- Rate: This is your hourly rate of pay.

- Amount: This is the total pay. It is calculated as Units x Rate.

- Total Pay: This is the total amount you earned before tax from all lines shown.

Bottom Section

- Taxable Pay: The amount of your earnings that have been taxed from this payment period only

- Non Taxable Pay: The amount of pay that is not subject to Tax.

- Total Pay: The total amount earned, before tax in this payment period.

- Total Deductions: The total amount deducted from your wages for Tax, NI and Pension contributions for this payment period.

- Net Pay: The amount that is left after all deductions have been made. This is the amount that will arrive in your bank account.

Tip: When you receive your payslip be sure to check the timesheet details match the sheet you submitted and that the hours have been calculated correctly. Did you get paid the amount you expected?

If you are unsure, or you do not understand the payment you have received be sure to contact your branch immediately.

Salary Checkers

Wondering what your take home pay will be? Click here to check out our handy salary calculator tool.

Career builders

Click here to access our free CV templates and our guide to creating a great CV. Click here to browse our latest jobs.

Get in touch

If you want to get in touch you can find your local branch here, or jump over to our Facebook page where you can join the community discussions or just say Hi!